Is PayPal craving Pinterest?

Digital settlements huge PayPal is apparently pondering a procurement of social networks and also purchasing system Pinterest, possibly producing a market juggernaut.

The $45 billion offer switches on San Jose, California-based PayPal supplying $70 a share for Pinterest, ladling concerning a 26% costs on Pinterest’s Tuesday closing cost, according to a record from Bloomberg, pointing out unrevealed resources. A representative for San Francisco-based Pinterest decreased to comment. A representative for PayPal really did not reply to an ask for remark.

” The secret to gathering extra purchases and also even more settlements is to make it as smooth as feasible,” stated Daniela Hawkins, a repayments expert with research study company Capco, calling the mix an excellent fit.

One-click sales on Pinterest that relocate via PayPal networks, placing products quickly en route to a customer’s residence, makes great company feeling, Hawkins stated in a meeting. Such a mix would certainly additionally permit PayPal accessibility to purchasing information that would certainly make it possible for extra targeted advertising and marketing, she included.

On the adverse side, Hawkins stated PayPal’s development, and also specifically its boosting economic solutions range, has actually drawn in remarkably restricted regulative interest to this factor, yet a bargain such as this accentuates its supremacy.

Pinterest’s shares rose on the report, resulting in a New york city trading stop for that supply Wednesday, yet PayPal’s supply sagged.

Largest PayPal acquisition

The acquisition, if finished, would certainly top a year in which settlements business have actually increase investing for a document quantity of purchases, driven in component by financial backing streaming to the market and also driving competitors. With fintechs, consisting of repayment start-ups, growing like weeds on the economic solutions landscape, tradition gamers and also brand-new participants alike have actually aspired to get up development and also shield their grass by implanting on even more services.

Pinterest would certainly be without a doubt PayPal’s largest ever before procurement, the Wall surface Road Journal reported, keeping in mind that, to day, the repayment firm’s biggest acquisition was of Honey Scientific research in 2019 for around $4 billion. With some $19 billion in readily available cash money and also cash money matchings, the Pinterest price would not be a challenge, the paper stated.

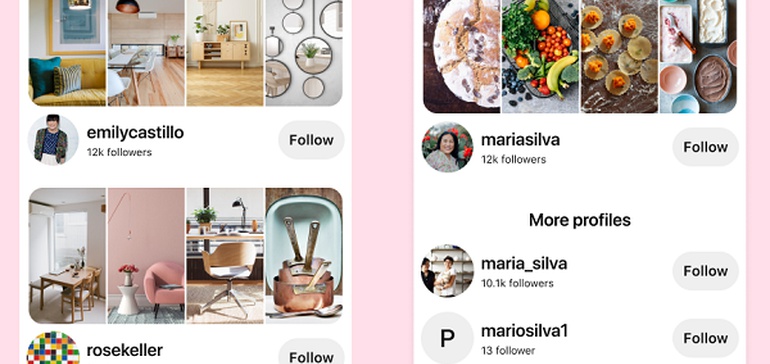

Pinterest matured as a social media sites site for customers “pinning” up details and also concepts on their passions, switching house style recommendations and also food preparation dishes, to name a few points. It has actually gained revenue from marketing on the website. Much more just recently Pinterest rotated, thus a lot of its peers, to integrate purchasing also, creating brand-new profits streams. Previously this year, it increased a worldwide collaboration with Shopify, expanding merchant accessibility for marketing via the website.

” In order for [PayPal] to take advantage of this possibility, [Pinterest] still requires executional enhancements consisting of: boosted seller onboard via store, SKU schedule onto the system, assimilation of buyable products right into the core customer offering, faster advertisement item advancement to boost targeting/performance, and also a reorganization/development of a sales pressure,” Morgan Stanley experts stated in a record Wednesday. “We are unsure just how [PayPal] would materially boost [Pinterest’s] capability to carry out on these variables faster.”

PayPal aspirations

For its component, PayPal has actually been dating extra networks for business as it escaped this year from a veteran connection with previous proprietor Ebay.com. Both consented to component methods 2015 via an offshoot, yet have actually been associated with a multi-year splitting up of their business connections.

Talking at a Financial institution of America seminar in June, PayPal chief executive officer Dan Schulman went over growing brand-new seller and also customer individuals. ” We’re seeing constant need for our solutions, perhaps even expanding need,” Schulman stated in the discussion with a Financial institution of America expert. “Our advertising and marketing is lastly beginning to begin in manner ins which we can actually gauge.”

A PayPal step right into the social purchasing area would certainly enhance its aspirations. It would certainly additionally raise PayPal’s competition with shopping leviathan Amazon.com, which has its very own settlements system and also does not allow clients make use of PayPal to get products.

” We are originally shocked by the suggested [PayPal-Pinterest] procurement provided the dimension and also keep in mind the deal can place [PayPal] in even more competitors with existing and also possible companions,” Cowen Equity Study experts stated in a record Wednesday, discussing the PayPal-Pinterest report.

Like various other fintechs, PayPal this year has actually additionally been concentrated on producing a “SuperApp,” that looks for to supply customers a plan of purchasing, repayment and also economic devices via their phones. Schulman has actually additionally welcomed cryptocurrencies and also QR codes as opportunities for boosting purchases that move via PayPal.

In going over the application at a capitalist day previously tihs year, Schulman discussed its “purchasing tab,” where customers can construct want list for acquisitions as well as additionally obtain promos from vendors, the Cowen record stated. Schulman revealed desires to get to 1 billion individuals via the system, according to the record.

Pinterest has concerning 459 million regular monthly energetic individuals, concerning two-thirds of whom are women, the firm stated in its yearly regulative declaring previously this year.

” Our company believe a possible procurement of [Pinterest] syncs with the Super Application growth approach to improve individuals and also interaction,” the Cowen record stated.

COVID enhances PayPal’s company

PayPal’s shares have greater than increased given that prior to the COVID-19 pandemic arised in March, rising on the shopping fad that occurred when customers mainly quarantined in the house and also changed en masse to net purchasing. Enhanced shopping equated right into even more customers making use of PayPal’s electronic repayment system for even more buying and also even more of them utilizing its peer-to-peer settlements device Venmo for moving funds.

PayPal’s energy has actually proceeded this year, with the firm’s web profits leaping 24% year over year to $12.2 billion for the initial fifty percent of 2021, and also earnings climbing up 41% to $2.3 billion through, contrasted to in 2015, according to a quarterly regulative declaring.

” Our company believe in the long-term pull towards shopping,” PayPal Principal Financial Policeman John Rainey stated on an incomes hire July. “Our company believe in the universality of electronic settlements. And also we wish to assist form that result. We wish to be a leader because area.”

The broach a purchase comes with a difficult time for Pinterest, with the firm’s founder and also board supervisor Evan Sharp, that additionally is its primary layout and also imaginative policeman, introducing previously this month that he would certainly leave the firm, Bloomberg reported. The firm, which pays, has actually additionally been coming to grips with claims, consisting of lawful insurance claims, from previous staff members that Pinterest victimized women employees.

Deal-making sustained by settlements

If the offer experiences, it would certainly make 2021 the busiest year ever before for mergings and also purchases, in spite of the overhang of the most dangerous pandemic in greater than a century. The quantity of international deal-making presently stands at $4.07 trillion until now this year, and also a PayPal-Pinterest merging would certainly catapult that amount past the previous document of $4.11 trillion embeded in 2007, according to information put together by Bloomberg.

Repayment market purchases, consisting of PayPal’s $2.7 billion acquisition of Japanese settlements company Paidy last month and also competing Square’s $29 billion acquisition of buy currently, pay later on firm Afterpay in August, have actually strengthened the deal-making numbers this year.

A PayPal-Pinterest deal would certainly additionally be among the largest customer net handle current years, surpassing Salesforce’s $27.7 billion procurement of Slack in 2015, the New york city Times reported.

Still, it’s not a done offer, and also if it does appear, the terms can still alter, the report stated.

Adhere To.

Lynne Marek.

on.

Twitter.