Paper Resource declares personal bankruptcy with strategies to offer itself

Market Suggestions:

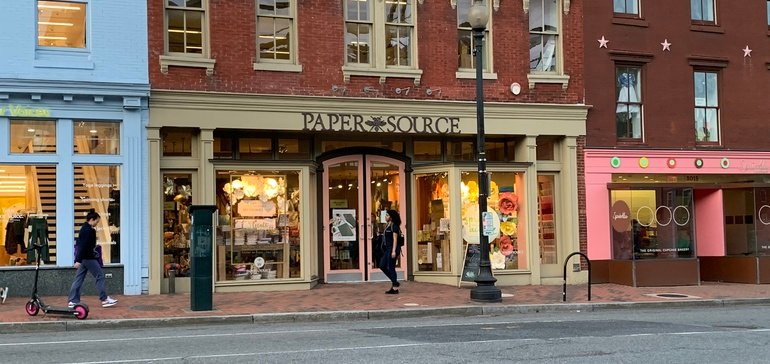

- Card as well as present store Paper Resource has actually applied for Phase 11 personal bankruptcy with a strategy to offer itself as well as shut at the very least 11 shops.

- The business, which runs 158 shops, has a tracking equine proposal from present loan providers led by MidCap Financial to get the business as well as offer $16.5 million in funding.

- The tracking equine proposal is valued at Paper Resource’s financial obligation responsibilities, consisting of $16 million for a debtor-in-possession center as well as $72.8 million on an initial lien center, according to court documents.

Dive Understanding:

About a year back, Paper Resource was a recipient of the autumn of a competitor, the card as well as stationery shop chain Papyrus, which sold off in very early 2020. At the time, Paper Resource took control of 30 of Papyrus’ shops, increasing Paper Resource’s shop fleet by greater than 20%.

A number of weeks after Paper Resource revealed the shop purchases, the retail globe experienced extreme turmoil as COVID-19’s spread in the united state came to be amazingly obvious, as well as optional merchants shuttered their shops either voluntarily or federal government order.

In the extensive economic interruption that adhered to, an additional market expert, the Paper Shop, applied for personal bankruptcy as well as marketed itself to a team of financiers led by a realty company.

Before the COVID-19 break out, Paper Resource had actually been “appreciating fast growth as well as continual sales development,” CFO Ronald Kruczynski claimed in court documents. However, together with its competitor as well as ratings of various other specialized merchants, Paper Resource “continual deep damages to their financial resources as well as procedures as an outcome of the recurring COVID-19 pandemic,” the exec claimed.

Established In 1983 by Susan Lindstrom, Paper Resource began with a solitary shop in Chicago to “display the charm of handmade documents from around the globe,” according to Kruczynski. Lindstrom expanded the store to 27 shops by 2007 prior to marketing a bulk risk to personal equity company Brentwood Associates.

Under Brentwood’s possession, Paper Resource included almost 25 even more shops prior to being gotten by an additional personal equity company, Investcorp International in 2013. From there, the store’s growth sped up a lot more while it additionally made financial investments in its omnichannel abilities.

Based generally in city as well as country retail locations– with fairly little focus in shopping centers– Paper Resource concentrates on a variety of item locations, amongst them publications as well as journals, bathroom as well as charm, treatment plans, kitchen area basics, art as well as craft materials, wedding event invites as well as event materials, to name a few, Kruczynski kept in mind. The store additionally uses youngsters’s art camps, ability workshops, style assessments on wedding event invites as well as various other solutions. The business, which creates concerning 40% of its very own items, has a wholesale service too.

Briefly shutting its shops in 2020, as well as the various other results of the pandemic, led income to drop from $153.2 million in 2019 to $104 million in 2020, Kruczynski claimed. The closures, furthermore, strike right at crucial vacations for the present vendor, consisting of Mommy’s Day as well as Easter.

The shop closures additionally indicated that Paper Resource “never ever understood the advantages” of obtaining Papyrus’ “ideal leases,” which the business spent for with aid from an $8 million financial investment from Investcorp, Kruczynski claimed.

Including stress throughout the pandemic dilemma were the store’s leases. Kruczynski claimed that, since its Phase 11 declaring, Paper Resource’s exceptional lease responsibilities stood at $15.8 million.

Proceeded spread of COVID-19 as well as tenancy restrictions on shops in lots of states have actually taken a toll on liquidity at Paper Resource, which was healthy and balanced prior to the pandemic though extremely leveraged, Kruczynski claimed. Also after finance mixtures, by February Paper Resource “once again located itself in an illogical setting with minimal liquidity, as well as substantial lease obligations that remained to install monthly,” according to the CFO.

Currently in personal bankruptcy, Paper Resource is seeking to transform secrets to the business over to loan providers, or a greater prospective buyer. While a regrettable turn, the tracking equine proposal reveals the loan providers still see worth in the store.

Paper Resource intends to hold a public auction for its service on April 21 as well as a sale hearing on April 30.

Adhere To.

Ben Unglesbee.

on.

Twitter.